Unlock Tangible Net Worth: Shareholder Loan Secrets!

Understanding tangible net worth calculation shareholder loan treatment is crucial for any business owner, especially when navigating complex financial landscapes. The Balance Sheet, a core financial statement, provides the raw data needed for this calculation. A shareholder loan, often involving entities such as a Limited Liability Company (LLC), can significantly impact this metric. The treatment of these loans, guided by principles of Generally Accepted Accounting Principles (GAAP), directly affects the calculated tangible net worth. Correct interpretation, especially in jurisdictions such as Delaware which are popular for business registration, allows accurate financial assessment.

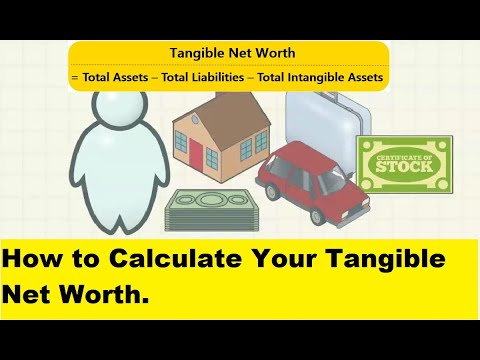

Image taken from the YouTube channel Financial And Investing Education , from the video titled How to Calculate Your Tangible Net Worth. .

Unlock Tangible Net Worth: A Deep Dive into Shareholder Loans

This article dissects the intricate relationship between shareholder loans and tangible net worth. Understanding how these loans affect your company’s financial health is crucial for attracting investors, securing financing, and making sound business decisions. We’ll focus on the tangible net worth calculation and the specific treatment of shareholder loans within that calculation.

Understanding Tangible Net Worth

Tangible net worth offers a more conservative view of a company’s value compared to its total net worth. It strips away intangible assets, like goodwill and patents, which can be subjective and difficult to liquidate. A strong tangible net worth suggests a more robust and stable financial foundation.

Why is Tangible Net Worth Important?

- Lender Perspective: Lenders often use tangible net worth to assess a company’s ability to repay debts. A higher tangible net worth indicates lower risk.

- Investor Confidence: Investors are often drawn to companies with a strong tangible net worth as it represents a more reliable indicator of asset value.

- Benchmarking: Comparing your company’s tangible net worth against industry peers provides valuable insight into its financial performance.

- Internal Assessment: Tracking changes in tangible net worth over time reveals trends in your company’s financial stability.

Formula for Calculating Tangible Net Worth

The basic formula is:

Tangible Net Worth = Total Assets - Intangible Assets - Total Liabilities

Alternatively, since:

Net Worth = Total Assets - Total Liabilities

We can also say:

Tangible Net Worth = Net Worth - Intangible Assets

The Impact of Shareholder Loans

Shareholder loans represent funds advanced to the company by its shareholders. These loans can significantly impact both the asset and liability sides of the balance sheet, and consequently, the tangible net worth calculation. The crucial aspect is how these loans are classified: as debt or equity.

Shareholder Loans as Debt

When a shareholder loan is treated as debt, it appears as a liability on the balance sheet. This directly reduces net worth, and subsequently, tangible net worth.

- How it Affects the Calculation: Increasing liabilities directly decreases both net worth and tangible net worth.

-

Example: Imagine a company has $100,000 in net worth, $20,000 in intangible assets, and a $30,000 shareholder loan classified as debt.

- Net Worth = $100,000

- Tangible Net Worth = $100,000 – $20,000 = $80,000

- With the shareholder loan as debt:

- Net Worth = $100,000 – $30,000 = $70,000

- Tangible Net Worth = $70,000 – $20,000 = $50,000

Shareholder Loans as Equity

In certain circumstances, shareholder loans might be treated as equity. This generally occurs when the loan has characteristics more aligned with an equity investment, such as:

- Subordination: The loan is subordinate to other creditors (meaning other lenders are paid first in case of bankruptcy).

- Lack of Fixed Repayment Schedule: There’s no strict timetable for repayment.

- Interest-Free or Low Interest Rate: The loan carries no interest or a significantly below-market interest rate.

- Capital Contribution: The loan is intended as a permanent or long-term investment in the company.

When treated as equity, the shareholder loan increases net worth and, therefore, potentially increases tangible net worth. (The increase in TNW depends if the additional equity investment increased intangible assets.)

- How it Affects the Calculation: When treated as equity, it doesn’t show up as a liability, thus preserving or increasing net worth and tangible net worth.

- Example (Continuing the previous example): If the $30,000 shareholder loan is reclassified as equity:

- Net Worth = $100,000 (without the loan as a liability) + $30,000 (Increase in Equity) = $130,000

- Tangible Net Worth = $130,000 – $20,000 = $110,000

Factors Influencing Loan Classification

Several factors determine whether a shareholder loan is classified as debt or equity. There is no single definitive rule, and the determination often relies on professional judgment and careful consideration of the specific circumstances. Key considerations include:

- Loan Documentation: Is there a formal loan agreement in place? Does it specify interest rates, repayment terms, and security?

- Repayment History: Has the company consistently made timely interest and principal payments?

- Debt-to-Equity Ratio: Does the company already have a high debt load? A high debt-to-equity ratio makes it more likely that the loan will be viewed as equity.

- Subordination: As mentioned above, is the loan subordinate to other debt?

- Use of Funds: Were the funds used for operating expenses or for capital investments? Funds used for capital investments are sometimes viewed as leaning toward equity.

- Tax Implications: The tax treatment of the loan can also provide clues about its true nature.

Practical Considerations and Best Practices

Understanding the impact of shareholder loans on tangible net worth is crucial for accurate financial reporting and strategic decision-making. Here are some practical considerations:

- Consult with Professionals: Seek advice from accountants and legal professionals to ensure the correct classification of shareholder loans based on your specific situation. This is the most important practice to follow.

- Document Everything: Maintain thorough documentation of all shareholder loans, including loan agreements, repayment schedules, and any modifications to the terms.

- Transparency: Be transparent with lenders and investors about the nature and treatment of shareholder loans.

- Regular Review: Periodically review the classification of shareholder loans to ensure it remains appropriate given changes in the company’s financial situation.

- Impact Analysis: Always consider the impact of shareholder loan transactions on your company’s tangible net worth and other key financial ratios. Use scenario planning.

By carefully considering the factors discussed above and working with qualified professionals, you can effectively manage shareholder loans to optimize your company’s tangible net worth and overall financial health.

FAQs: Understanding Shareholder Loans and Tangible Net Worth

Shareholder loans can impact your company’s financial health. Here are some frequently asked questions to help you understand how they affect your tangible net worth.

What is a shareholder loan and why does it matter?

A shareholder loan is money lent to or borrowed from a company by its shareholders. Understanding these loans is crucial because they affect the balance sheet and impact calculations like tangible net worth.

How do shareholder loans affect tangible net worth calculation?

Generally, shareholder loans owed to the company are considered assets. However, shareholder loans owed by the company are liabilities. These loans can significantly alter your tangible net worth depending on their size.

Are shareholder loans always treated as debt in tangible net worth calculation?

Not necessarily. Subordinated shareholder loans (loans that get repaid after other creditors) might be treated differently, especially when assessing a company’s solvency. Always consider the loan terms when determining shareholder loan treatment.

What happens if a shareholder loan is forgiven?

If a shareholder loan is forgiven, it is generally considered a contribution to equity if the loan was owed to the shareholder. This will positively impact your tangible net worth calculation. Forgiving a loan owed to the company is usually considered income.

So, there you have it! Hopefully, you now have a better handle on tangible net worth calculation shareholder loan treatment. Go forth and put that knowledge to good use!