Large Deviation Theory: Unveiling Finance’s Hidden Risks

Large deviation theory, a powerful mathematical framework, provides critical insights into the rare but significant events often overlooked by traditional financial models. Risk management, a core function of institutions like Goldman Sachs, benefits immensely from the enhanced accuracy offered by large deviation theory in quantifying extreme risks. The Cramér’s theorem, a foundational result within large deviation theory, offers a precise way to estimate the probability of rare events. Monte Carlo simulations, while valuable for risk assessment, can be computationally expensive; large deviation theory offers complementary analytical techniques for situations where Monte Carlo methods become impractical.

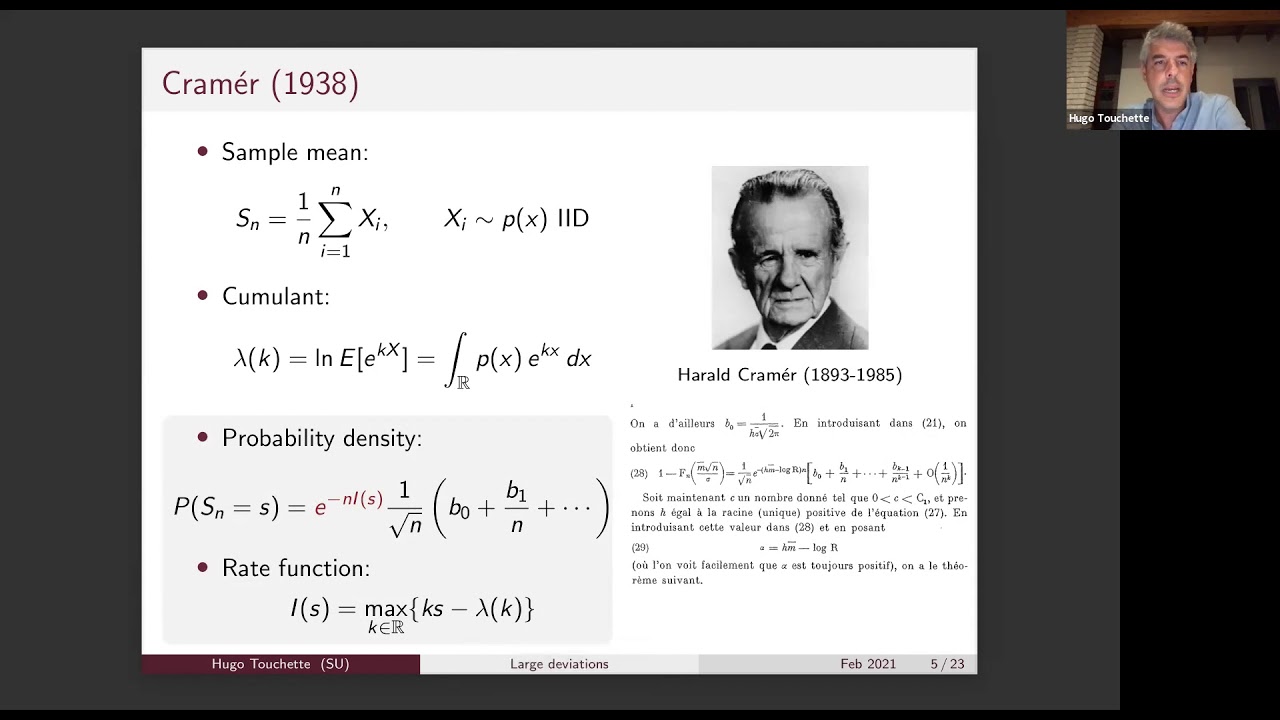

Image taken from the YouTube channel Jean-Luc Thiffeault , from the video titled Large deviation theory: From physics to mathematics and back (Hugo Touchette) .

Crafting an Effective Article Layout: Large Deviation Theory and Financial Risk

To create a compelling and informative article on "Large Deviation Theory: Unveiling Finance’s Hidden Risks," a structured approach is essential. The layout should guide the reader logically through the theoretical foundations, practical applications, and limitations of large deviation theory (LDT) in a financial context.

Introduction: Setting the Stage

This section should provide a high-level overview of the article’s purpose and scope.

- Hook: Start with a compelling scenario. For instance, a brief discussion of a major financial market crash or unexpected event. Frame the question: How can we better understand and anticipate these extreme events?

- Define the problem: Explain the limitations of traditional risk management models (e.g., assuming normality) when dealing with "tail risk" – rare but potentially catastrophic events.

- Introduce Large Deviation Theory: Briefly define large deviation theory as a mathematical framework for analyzing the probability of rare events. Highlight its relevance in understanding extreme financial outcomes.

- Thesis Statement: Clearly state the article’s main argument. For example: "This article explores how large deviation theory can be applied to identify, quantify, and potentially mitigate hidden risks in financial systems, offering insights beyond those provided by standard statistical techniques."

- Roadmap: Briefly outline the topics to be covered in the subsequent sections.

Theoretical Foundations of Large Deviation Theory

This section delves into the core concepts of LDT.

Core Concepts

- Rate Function (or Cramér Function): This is the heart of LDT.

- Explain that the rate function quantifies the exponential decay rate of the probability of rare events.

- Illustrate the concept with a simple example (e.g., coin flips, deviations from the mean).

- Mathematical notation can be introduced here, focusing on intuitive explanation rather than rigorous proofs. For example:

- P(X > x) ≈ exp(-I(x)), where I(x) is the rate function.

- Large Deviation Principle (LDP): Explain that the LDP states that probabilities of rare events decay exponentially, governed by the rate function.

- Importance Sampling: Briefly mention this simulation technique, which is often used in conjunction with LDT to estimate the probabilities of rare events.

- Emphasize that importance sampling aims to efficiently simulate rare events, unlike standard Monte Carlo methods that may require an impractically large number of simulations.

Key Theorems

- Cramér’s Theorem: Explain this fundamental theorem, which provides a large deviation principle for sums of independent and identically distributed random variables.

- Gärtner-Ellis Theorem: Describe how this theorem generalizes Cramér’s theorem to a broader class of random variables.

- Sanov’s Theorem: Briefly mention this theorem, which deals with empirical measures and deviations from the typical empirical distribution.

Applications in Finance

This section explores concrete applications of LDT in financial risk management.

Risk Management

- Credit Risk:

- Explain how LDT can be used to model defaults in credit portfolios.

- Discuss how it addresses the limitations of traditional credit risk models that often underestimate tail risk.

- Consider examples of credit derivatives and their sensitivity to extreme events.

- Market Risk:

- Discuss applications in option pricing, particularly for exotic options that are sensitive to large market movements.

- Explain how LDT can be used to estimate Value-at-Risk (VaR) and Expected Shortfall (ES) more accurately, especially in non-normal market conditions.

- Address how LDT improves VaR calculation:

- Traditional VaR models are often based on historical data and assumptions of normality, which might not hold during extreme market events.

- LDT helps to more accurately estimate the probabilities of extreme losses, especially in the tail of the loss distribution.

- Operational Risk:

- Explore how LDT can be applied to model rare but significant operational failures, such as cyberattacks or large-scale system outages.

Algorithmic Trading and High-Frequency Finance

- Explain how LDT can be used to analyze and optimize algorithmic trading strategies.

- Discuss applications in detecting and mitigating flash crashes.

Insurance

- Describe applications in reinsurance and the pricing of catastrophe bonds.

Limitations and Challenges

This section provides a balanced perspective by acknowledging the limitations of LDT.

- Model Complexity: LDT models can be mathematically complex and require specialized knowledge.

- Data Requirements: Accurate estimation of rate functions requires sufficient data, which may be scarce for extremely rare events.

- Computational Challenges: Implementing LDT-based risk management tools can be computationally intensive, especially for large portfolios.

- Model Risk: As with any model, there is a risk that the LDT model itself is misspecified or that the underlying assumptions are violated.

- How to handle model risk: model validation and sensitivity analysis are crucial.

Future Directions

- Highlight emerging research areas and potential future applications of LDT in finance.

- Mention the potential for integrating LDT with machine learning techniques to improve risk forecasting.

- Discuss the increasing importance of LDT in the context of climate risk and other systemic risks.

Frequently Asked Questions about Large Deviation Theory and Financial Risk

This FAQ addresses common questions about applying large deviation theory to understanding and managing financial risks.

What exactly is large deviation theory and how does it relate to finance?

Large deviation theory is a mathematical framework for analyzing rare events. In finance, it helps us understand the probability of extreme events like market crashes or significant portfolio losses, events that traditional statistical methods often underestimate.

How does large deviation theory differ from standard risk models in finance?

Standard risk models often assume normal distributions, which can underestimate the probability of extreme events. Large deviation theory provides a more accurate assessment by explicitly considering the behavior of probabilities in the "tails" of the distribution, where these rare but impactful events reside. It acknowledges that large deviations from the mean are more probable than a normal distribution would suggest.

Can you give a concrete example of where large deviation theory is useful in finance?

Imagine a portfolio of investments. Standard risk measures might suggest a relatively low probability of losing, say, 20% of its value. However, large deviation theory can reveal that due to underlying dependencies and non-normal asset returns, the actual probability of such a loss is significantly higher. It helps with more accurate risk assessment for portfolio management.

What are some limitations of using large deviation theory in financial risk assessment?

Applying large deviation theory requires significant mathematical expertise and can be computationally intensive. Accurate implementation relies on understanding the underlying stochastic processes governing financial markets and requires careful selection of appropriate models. Moreover, the theory provides asymptotic results, so the accuracy of approximations depends on the scale of the "large" deviation.

So, there you have it! Hopefully, this exploration of large deviation theory has shed some light on how it can help us better understand and manage those tricky, unexpected financial events. Dive deeper, explore further, and keep an eye out for when large deviation theory pops up next – you might be surprised!