IPP Math Insurance: Unlock Financial Security with This Secret

Are you ready to unlock true financial security for yourself and your loved ones in the United States? Many view life insurance as an impenetrable fortress of complexity, filled with bewildering terms and opaque processes. But what if we told you that understanding its core isn’t about deciphering jargon, but about grasping the surprisingly accessible ‘math’ behind it?

This blog post will demystify Individual Premium Payment (IPP) Life Insurance by revealing 5 crucial ‘secrets’ and their intricate dance with fundamental mathematical concepts. From understanding how your premium payments are meticulously calculated to appreciating their long-term contribution to your financial security, we’ll empower you to navigate this essential tool with confidence and clarity.

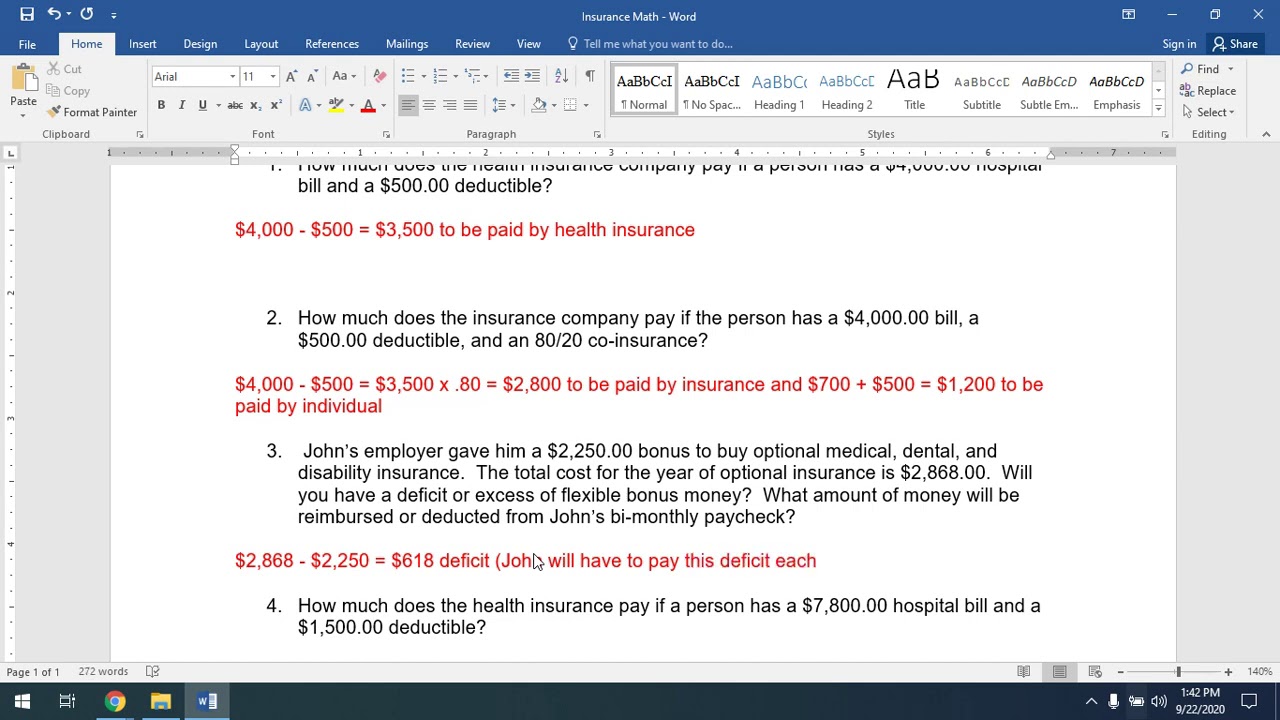

Image taken from the YouTube channel Emily Wheeley , from the video titled Health Insurance Guided Math .

In the intricate landscape of personal finance, securing one’s future often feels like navigating a complex maze.

Unlocking Financial Confidence: The Simple Math Behind IPP Life Insurance for a Secure Future

For many in the United States, the concept of Individual Premium Payment (IPP) Life Insurance stands as a cornerstone of robust financial planning. Far from being just another insurance product, IPP life insurance represents a powerful commitment to protecting loved ones and building a legacy, offering a crucial layer of financial security that can adapt to individual needs and circumstances over time. It’s a strategic tool designed to provide peace of mind, knowing that your financial responsibilities and future aspirations are safeguarded, regardless of life’s uncertainties.

Demystifying Life Insurance: It’s Not as Complicated as You Think

The term "life insurance" often conjures images of dense legal documents, confusing terminology, and intricate calculations. This common misconception leads many to believe that it’s an overly complex financial instrument best left to experts. However, we believe that understanding the fundamental principles, particularly the underlying ‘math’ of how premiums are calculated and how benefits accumulate, makes IPP life insurance remarkably accessible. It’s not about mastering advanced calculus, but rather grasping a few core concepts that empower you to make informed decisions about your financial well-being. By stripping away the jargon and focusing on the logical, mathematical framework, anyone can begin to understand its profound value.

Your Guide to IPP Life Insurance: The 5 Secrets and Their Mathematical Foundation

This blog aims to dismantle the barriers of complexity surrounding IPP life insurance. Our purpose is clear: to demystify this vital financial tool by unveiling five key ‘secrets’ that govern its effectiveness and value. Each ‘secret’ isn’t just a piece of advice; it’s intricately linked to fundamental mathematical concepts that determine everything from your premium payments to the growth of your policy’s cash value and the eventual payout to your beneficiaries. We’ll explore how these mathematical principles play out in real-world scenarios, transforming abstract ideas into practical insights you can use.

The Power of Premiums: Building Long-Term Financial Security

At the heart of IPP life insurance lies the consistent act of making premium payments. These aren’t just monthly or annual fees; they are regular investments in your future and the financial stability of those you care about most. Understanding how these premiums contribute to long-term financial security is essential. Each payment helps build the policy’s value, whether it’s through ensuring a death benefit for your heirs or accumulating cash value that can be accessed during your lifetime. It’s a disciplined approach to saving and protecting, where consistent contributions translate directly into enduring financial resilience. By grasping the direct correlation between your premium payments and the security they provide, you unlock a deeper appreciation for this crucial planning tool.

Now that we’ve set the stage, let’s begin to uncover these foundational truths.

The previous section highlighted how IPP life insurance is a cornerstone for achieving financial security. Now, let’s pull back the curtain on this vital tool.

Secret #1: Your Personal Financial Anchor – Unpacking Individual Premium Payment Life Insurance

When it comes to safeguarding your family’s future, the concept of life insurance often comes up. But not all policies are created equal, and understanding the nuances is the first crucial step. At the heart of personalized protection lies Individual Premium Payment (IPP) Life Insurance, a powerful financial instrument designed specifically for you and your unique circumstances.

What Exactly is Individual Premium Payment (IPP) Life Insurance?

At its core, Individual Premium Payment (IPP) Life Insurance refers to a policy that you, as an individual, purchase and pay for directly. Unlike policies provided through an employer, an IPP policy is your personal asset, managed and maintained by you. Its primary and most crucial purpose is to provide a death benefit – a pre-determined sum of money paid directly to your chosen beneficiaries upon your passing.

Think of it as a personal financial safety net that you meticulously construct. Should the unexpected occur, this death benefit serves as a vital financial lifeline, offering crucial support to your loved ones. It can cover immediate expenses, replace lost income, pay off debts, fund children’s education, or maintain their standard of living, ensuring their financial stability continues even in your absence.

Standing Apart: IPP vs. Group Life Insurance

While many people may have some form of life insurance through their job, IPP life insurance offers distinct advantages that set it apart from group or employer-sponsored plans:

- Individual Ownership and Portability: An IPP policy is entirely yours. This means it’s fully portable; it stays with you regardless of job changes, career breaks, or retirement. There’s no risk of losing coverage if you leave your employer.

- Customization for Your Needs: Unlike a one-size-fits-all group plan, IPP allows for extensive customization. You have the freedom to choose the exact coverage amount that aligns with your financial obligations and future goals, select specific policy features (known as riders), and tailor the policy to fit your unique family structure and financial strategy.

- Guaranteed Coverage: Once an IPP policy is issued, the coverage generally remains in force as long as premiums are paid. Employer-sponsored plans, while convenient, often offer limited coverage amounts and can be subject to changes by the employer or even cancellation if you leave the company.

This individual ownership empowers you to design a policy that truly reflects your long-term vision for your loved ones’ financial security.

Flexibility in the IPP Landscape: Policy Types and Premium Structures in the United States

One of the most appealing aspects of IPP life insurance in the United States is the wide range of policy types available, each offering different features, benefits, and premium payment structures. This flexibility allows policyholders to choose a plan that best suits their financial goals, budget, and risk tolerance.

Understanding the Core Policy Types

Generally, IPP life insurance policies fall into two main categories:

- Term Life Insurance: This type provides coverage for a specific period, or "term," such as 10, 20, or 30 years. If the insured passes away within this term, the death benefit is paid. If the term expires and the insured is still alive, the coverage ends, and there is no payout. Term life is often the most affordable option, especially for younger individuals, as it does not build cash value.

- Whole Life Insurance: As its name suggests, whole life insurance provides coverage for the entire lifetime of the insured, as long as premiums are paid. A key feature of whole life is its cash value component, which grows over time on a tax-deferred basis. Policyholders can typically borrow against this cash value or even surrender the policy for its cash value. Premiums are generally fixed for the life of the policy.

- Universal Life Insurance: This is another form of permanent life insurance that offers more flexibility than whole life. It also has a cash value component and provides lifetime coverage. However, universal life policies often allow policyholders to adjust their premium payments and death benefit amount within certain limits, making it adaptable to changing financial circumstances.

Navigating Premium Payments

The structure of your premium payments is directly tied to the type of IPP policy you choose:

- Fixed vs. Adjustable Premiums: Term life and whole life policies typically have fixed premiums that remain constant for the duration of the term or the life of the policy, providing predictability for your budget. Universal life policies, on the other hand, offer more adjustable premiums, allowing you to pay more or less than the target premium, which impacts the cash value growth and death benefit.

- Payment Frequency: Most insurers offer flexibility in how often you pay your premiums – typically monthly, quarterly, semi-annually, or annually. Annual payments often result in a slightly lower overall cost compared to more frequent installments.

The choice between these policies and their premium structures depends heavily on your individual needs for coverage duration, cash value accumulation, and budget predictability.

IPP Life Insurance: A Pillar of Effective Financial Planning

Understanding and strategically utilizing IPP life insurance is not merely about having a policy; it’s a cornerstone of effective financial planning. It acts as a foundational layer of protection, ensuring that even if the primary income earner is no longer present, the financial goals and well-being of the family remain intact.

By incorporating IPP life insurance into your financial strategy, you’re not just buying a product; you’re investing in peace of mind, future security, and the lasting legacy you wish to leave for your loved ones. It’s about proactive planning, mitigating risks, and building a resilient financial future for those who matter most.

Once you grasp the fundamentals of IPP, the next logical step is to understand the forces that shape its cost.

Now that we’ve peeled back the layers on what Individual Premium Payment (IPP) life insurance is, it’s time to delve into the engine that powers these policies: their premiums.

Cracking the Code: The Actuarial Equation Behind Your IPP Premiums

At its core, your IPP premium isn’t just an arbitrary number; it’s the result of sophisticated mathematical calculations designed to ensure the insurer can fulfill its promise to you, no matter what. This intricate process is the domain of Actuarial Science, a discipline that uses statistics, probability, and financial theory to assess and manage risk. Insurers pool the premiums of many policyholders, using these funds to pay out death benefits, cover operational costs, and build reserves, all while aiming for financial stability.

The Actuarial Blueprint: How Premiums Are Built

Think of your premium as your contribution to a collective risk pool. Actuaries, the architects of this system, analyze vast amounts of data to predict future events, specifically how long policyholders are likely to live and when death benefits will need to be paid. They calculate the likelihood of claims, the expenses involved, and factor in investment earnings to arrive at a fair price for the coverage. The goal is to charge enough to cover future payouts and operating costs, without overcharging, ensuring the policy remains competitive and sustainable.

Decoding the Drivers: Factors Influencing Your IPP Premium

Several critical elements come into play when actuaries calculate your specific premium. These factors reflect your individual risk profile and the nature of the coverage you choose.

Your Personal Profile: Age, Health, and Lifestyle

- Age: This is arguably the most significant factor. Simply put, the older you are when you apply for an IPP policy, the higher your premium will generally be. Why? Because the older you are, the closer you statistically are to the end of your life expectancy, increasing the likelihood that the insurer will pay out the death benefit sooner rather than later.

- Health: Your current health status and medical history play a crucial role. Insurers assess factors like pre-existing conditions (e.g., diabetes, heart disease), your Body Mass Index (BMI), and family medical history. Individuals in excellent health typically receive more favorable rates, as they are statistically expected to live longer, delaying the payout of the death benefit.

- Lifestyle: Your daily habits and occupation can also influence your premium. Smokers, for instance, face significantly higher premiums due to the increased health risks associated with tobacco use. Similarly, individuals with hazardous occupations (e.g., roofers, pilots, miners) or dangerous hobbies (e.g., skydiving, competitive racing) may see higher rates due to the elevated risk of accidental death.

Policy Specifics: Type and Death Benefit

- Policy Type: While we’re focusing on IPP, the overarching type of life insurance (e.g., term life vs. whole life) impacts the premium structure. Whole life policies, which offer lifelong coverage and build cash value, typically have higher premiums than term life policies, which cover a specific period.

- Chosen Death Benefit Amount: This is straightforward: the more money you want your beneficiaries to receive upon your passing, the higher your premium will be. A larger death benefit represents a greater financial obligation for the insurer, thus requiring a larger contribution from you.

The Insurer’s Edge: Interest Rates and Risk Management

Beyond individual risk factors, the broader economic environment also impacts your IPP premium. Interest rates and the insurer’s investment returns are vital components. Life insurance companies don’t just hold your premiums in a vault; they invest them conservatively to generate returns. These investment earnings help offset the cost of providing coverage. In an environment with higher interest rates, insurers can potentially earn more on their investments, which might allow them to offer more competitive premiums or manage their risk more effectively. Conversely, lower interest rates can put upward pressure on premiums. This investment strategy is crucial for their risk assessment, enabling them to manage the inherent uncertainties of future claims while ensuring the long-term solvency of the policies they offer.

Your Commitment, Your Security: The Power of Consistent Payments

Ultimately, your consistent premium payments are the bedrock of your IPP policy. Each payment contributes to the collective pool and directly ensures that the promised death benefit will be available to your loved ones when they need it most. By maintaining your policy, you are actively building a safety net that contributes significantly to your family’s long-term financial security, providing peace of mind knowing that their future is protected.

Premium Dynamics: An Illustrative Table

To further illustrate how these factors interact, consider the following hypothetical scenarios for typical IPP premium calculations. Please note these are simplified examples and actual premiums would vary based on a comprehensive underwriting process.

| Factor | Example Scenario | Death Benefit | Estimated Monthly Premium (Sample) | Impact Highlight |

|---|---|---|---|---|

| Age | 30-year-old, excellent health | $250,000 | $35 | Lower age, lower premium |

| 50-year-old, excellent health | $250,000 | $75 | Higher age, higher premium | |

| Health | 30-year-old, excellent health | $250,000 | $35 | Good health, lower premium |

| 30-year-old, controlled diabetes | $250,000 | $60 | Health condition increases premium | |

| Death Benefit | 30-year-old, excellent health | $100,000 | $18 | Smaller benefit, lower premium |

| 30-year-old, excellent health | $500,000 | $65 | Larger benefit, higher premium |

Understanding these underlying calculations is a crucial step towards mastering your financial future, especially when we consider the power of present value and the time value of money.

Building on our understanding of the mathematical underpinnings of your IPP, we now delve into another critical concept that shapes the very fabric of your policy’s value.

The Time Machine of Money: Decoding Your IPP’s True Worth with Present Value

Have you ever considered that a dollar today is not the same as a dollar a year from now? This fundamental truth lies at the heart of "Present Value" (PV) and the "Time Value of Money" (TVM), concepts crucial for comprehending your IPP life insurance. Simply put, TVM states that money available now is worth more than the same amount in the future due to its potential earning capacity. Present Value is the flip side, telling us what a future sum of money is worth today, given a specific rate of return or discount rate.

What Are Present Value and the Time Value of Money in IPP?

In the context of IPP life insurance, these concepts are vital for both the insurer and the policyholder:

- Time Value of Money (TVM): This principle acknowledges that the cash you pay in premiums today could otherwise be invested and grow. Similarly, the death benefit your beneficiaries might receive years from now has less "buying power" today than its future face value.

- Present Value (PV): This is a calculation that essentially "discounts" a future amount of money back to its current equivalent. For instance, a $1,000 death benefit payable in 20 years isn’t worth $1,000 today; its present value would be a lesser amount because that future $1,000 could theoretically be generated by investing a smaller sum today.

How Insurers Use Present Value for IPP Life Insurance

Insurers are sophisticated financial institutions that must carefully balance their income (from premiums) against their future liabilities (death benefits and other payouts). Present Value is their primary tool for this delicate balancing act:

- Assessing Future Death Benefit Payouts: When an insurer issues an IPP policy, they are committing to a future death benefit. They don’t just look at the face value; they calculate its present value. This tells them how much money they would need to set aside today (or earn over time) to meet that future obligation. A higher future death benefit means a higher present value liability for the insurer.

- Evaluating Incoming Premium Payments: Similarly, the series of premium payments you’ll make over the life of your policy represents future income for the insurer. They use Present Value to determine the current worth of this entire stream of payments. This allows them to compare the "present value of future premiums" against the "present value of future death benefits and operational costs" to ensure the policy is financially viable.

Discounting Future Premiums: Unveiling the True Cost

To truly understand a policy’s cost and profitability, insurers don’t just add up all the premiums you’re expected to pay. Instead, each future premium payment is discounted back to its present value. This process considers that money received sooner is more valuable than money received later.

Imagine you’re paying $1,000 annually. That $1,000 paid 10 years from now is worth less to the insurer today than the $1,000 paid this year. By summing the present values of all anticipated premium payments, the insurer arrives at a comprehensive figure representing the actual current value of the income stream they expect from your policy. This is critical for:

- Pricing the Policy: Ensuring premiums are adequate to cover future claims and company expenses.

- Profitability Analysis: Determining if the policy is likely to generate a profit over its lifetime.

- Reserving Requirements: Calculating how much capital needs to be held in reserve to cover future obligations.

The Impact of Varying Interest Rates

Interest rates play a pivotal role in Present Value calculations. They act as the "discount rate" – the rate at which future money is brought back to its present worth.

- Higher Interest Rates: When interest rates are high, the present value of a future sum decreases. This is because a smaller amount of money invested today at a higher rate can grow to the same future sum. For insurers, higher interest rates mean:

- The present value of their future death benefit liabilities appears lower.

- The present value of your future premium payments appears lower.

- This can potentially lead to lower premiums for policyholders, as the insurer can generate the required future funds with less present capital.

- Lower Interest Rates: Conversely, when interest rates are low, the present value of a future sum increases. A larger amount of money is needed today to grow to the same future sum. For insurers, lower interest rates mean:

- The present value of their future death benefit liabilities appears higher.

- The present value of your future premium payments appears higher.

- This often translates to higher premiums for policyholders, as insurers need more upfront capital to meet future obligations in a low-yield environment.

This dynamic illustrates why market interest rates are a significant factor in premium setting and policy performance, especially for long-term products like IPP life insurance.

Simplified Present Value Calculation Example

Let’s look at a simplified example of how Present Value is calculated for a future payment, considering different interest rates. This table assumes a single payment (e.g., a death benefit or a large premium) due in the future.

| Future Payment Amount | Years Until Payment | Discount Rate (Interest Rate) | Present Value | Interpretation |

|---|---|---|---|---|

| $100,000 | 10 | 3% | $74,409 | To have $100,000 in 10 years, you’d need to invest $74,409 today at 3%. |

| $100,000 | 10 | 5% | $61,391 | To have $100,000 in 10 years, you’d need to invest $61,391 today at 5%. |

| $100,000 | 20 | 3% | $55,368 | To have $100,000 in 20 years, you’d need to invest $55,368 today at 3%. |

| $100,000 | 20 | 5% | $37,689 | To have $100,000 in 20 years, you’d need to invest $37,689 today at 5%. |

Formula used: PV = FV / (1 + r)^n, where FV = Future Value, r = discount rate, n = number of periods.

As you can see, higher interest rates and longer timeframes significantly reduce the present value of a future sum.

Empowering Policyholders Through Understanding TVM

Grasping the Time Value of Money and Present Value isn’t just for insurers; it’s a powerful tool for you, the policyholder, in your financial planning:

- Evaluating Long-Term Cost: By understanding that your future premium payments have a present value, you can better assess the true "cost" of your policy today, rather than just summing up future nominal payments. This helps you compare different IPP options more effectively.

- Assessing Benefit Value: Similarly, knowing the present value of a potential future death benefit allows you to consider its real-world impact in today’s terms, aiding in financial planning for your beneficiaries.

- Informed Decision-Making: When considering policy changes, surrender values, or comparing different investment strategies alongside your IPP, a TVM perspective enables you to make more financially sound decisions. It helps you weigh the benefit of having cash now versus a larger sum later.

- Understanding Policy Performance: For policies with cash value components, understanding how interest rates and time horizons impact present value helps you appreciate the growth potential and the actual worth of your policy over its lifetime.

By looking beyond the nominal figures and applying the lens of Present Value, you gain a sophisticated understanding of your IPP’s financial dynamics, transforming you from a passive payer into an informed financial strategist. This foundational understanding of value over time sets the stage for grasping how insurers meticulously assess risk, which is our next crucial secret.

While the previous section illuminated how understanding the time value of money optimizes your IPP, a fundamental companion to this is accurately forecasting future uncertainties.

Beyond the Crystal Ball: The Science That Defines Your Life Insurance Premium

In the intricate world of Individual Premium Payment (IPP) Life Insurance in the United States, mastering risk assessment isn’t just good practice—it’s the bedrock of the entire system. Without a robust method to predict the likelihood of future events, an insurer couldn’t possibly offer a sustainable product, let alone a fair one. This is where the profound insights of actuarial science come into play, transforming complex variables into clear, actionable data that ensures your life insurance promise can always be kept.

The Actuarial Engine Room: Predicting Future Claims

At its core, life insurance is a contract built on uncertainty. You pay premiums for a promise that, should you pass away, your beneficiaries will receive a specified death benefit. But how does an insurance company know how much to charge you today to cover a potential payout decades from now? This is precisely the domain of Actuarial Science.

Actuaries are expert statisticians and risk managers who utilize sophisticated mathematical and statistical models to:

- Predict Future Claims: By analyzing vast datasets, actuaries can estimate the probability of various events occurring within a defined population.

- Calculate Potential Payouts: They translate these probabilities into expected financial costs for the insurer.

A key tool in their arsenal is statistical data, which includes:

- Mortality Tables: These tables provide data on the probability of death at various ages, broken down by factors like age, gender, and sometimes even smoking status. They are crucial for estimating how long, on average, a policyholder is expected to live.

- Morbidity Rates: While less central to pure life insurance, morbidity data (rates of illness or disability) can be relevant for riders or policies that include living benefits.

- Other Demographic Data: Factors such as socioeconomic status, geographic location, and even historical claims data play a role in refining these predictions.

This scientific approach allows insurers to move beyond guesswork, ensuring that the premiums collected are sufficient to cover the expected future death benefits for all policyholders.

The Underwriting Lens: Personalizing Your Premium

While actuarial science provides a broad framework based on population data, life insurance is ultimately an individual contract. This is where the underwriting process becomes critical. Underwriting is the detailed assessment of an individual applicant’s specific risk profile. It’s the process by which an insurer determines whether to accept your application and, if so, what your personalized premium payment will be.

During underwriting, the insurer evaluates various factors that could impact your longevity and, therefore, the likelihood of a claim. The goal is to ensure that the premium you pay accurately reflects the specific risk you bring to the insurance pool.

Your Individual Risk Profile

Underwriters consider a comprehensive range of information, often categorized as follows:

| Factor | Description | Impact on Risk & Premium |

|---|---|---|

| Medical History | Past and current health conditions, family medical history, prescription use. | Higher risk conditions (e.g., heart disease, diabetes) can increase premiums. |

| Lifestyle Choices | Smoking, alcohol consumption, drug use, dietary habits. | Smoking significantly increases mortality risk and premiums. |

| Occupation | Hazardous jobs (e.g., deep-sea fishing, construction, piloting). | Higher risk occupations may incur higher premiums or policy exclusions. |

| Hobbies/Activities | Participation in high-risk sports (e.g., skydiving, rock climbing, racing). | Dangerous hobbies can lead to higher premiums or specific exclusions. |

| Age | The older you are, the higher the natural mortality risk. | Premiums generally increase with age at the time of policy purchase. |

| Gender | Statistical differences in life expectancy between men and women. | Reflected in actuarial tables, influencing gender-specific rates. |

| Driving Record | History of accidents, DUIs, or numerous traffic violations. | Indicates higher risk-taking behavior, potentially increasing premiums. |

By meticulously analyzing these elements, the underwriting team assigns a risk class to each policyholder. This classification directly influences the personalized premium payments, ensuring that individuals with lower risk profiles benefit from more favorable rates, while those with higher risks contribute appropriately to the shared risk pool.

The Premium Equation: Fairness, Equity, and Sustainability

The direct connection between risk assessment and premium payments is fundamental to the integrity and fairness of the life insurance system.

- Fairness: Policyholders pay a premium that is commensurate with their individual risk of a claim, rather than subsidizing higher-risk individuals.

- Equity: The system ensures that the cost of insurance is equitably distributed among all policyholders based on their unique profiles.

- Sustainability: By accurately assessing and pricing risk, insurers collect sufficient funds to cover future claims, preventing insolvency and ensuring the long-term viability of the product.

This meticulous process ensures that the collective premiums generated are robust enough to meet future obligations, even when unexpected events occur.

Safeguarding the Promise: Insurer Solvency and Death Benefit Viability

Ultimately, the most critical outcome of accurate risk assessment is the assurance it provides for both the insurer and the policyholder.

- Insurer Solvency: By correctly forecasting claims and setting appropriate premiums, insurance companies maintain financial stability. This solvency is paramount; a bankrupt insurer cannot pay claims.

- Long-Term Viability of the Death Benefit: For you, the policyholder, accurate risk assessment means confidence that the death benefit promised will indeed be available for your beneficiaries, precisely when they need it most. It safeguards the fundamental purpose of your IPP life insurance: to provide financial security and peace of mind for your loved ones far into the future.

Understanding how risk is assessed transforms your perception of premiums from an arbitrary cost to a calculated investment in a secure future, setting the stage for how you strategically integrate IPP into your broader financial landscape.

Building on our understanding of how actuarial science underpins effective risk assessment, we can now shift our focus from understanding the mechanics to leveraging them strategically.

Your Wealth, Your Legacy: Architecting Financial Security with IPP Life Insurance

Individual Premium Payment (IPP) Life Insurance, often viewed simply as a protective measure, is, in fact, a powerful and versatile cornerstone of a well-rounded financial strategy for individuals and families across the United States. When integrated thoughtfully, IPP transcends basic coverage, becoming a dynamic tool for wealth building, legacy creation, and long-term financial security. It’s about proactive planning, ensuring that your financial goals are not just met, but amplified and protected for generations.

Strategic Integration: IPP in Your Financial Blueprint

A comprehensive financial plan looks beyond today’s income and expenses; it considers future aspirations, potential challenges, and the legacy you wish to leave. This is where IPP Life Insurance shines. It’s not a standalone product but an integral component designed to complement investments, savings, and retirement plans.

By incorporating IPP, policyholders can:

- Protect Income Streams: Ensure that dependants are financially secure, even if the primary earner is no longer able to provide.

- Supplement Retirement Income: Certain types of IPP policies can accumulate cash value over time, which can be accessed later in life to supplement retirement funds.

- Mitigate Financial Risks: Beyond the death benefit, IPP can protect against various financial setbacks, ensuring liquidity when needed most.

- Provide Tax Advantages: In many cases, the death benefit paid to beneficiaries is income-tax-free, offering a significant advantage for wealth transfer.

Securing Your Legacy: Wealth Transfer and Estate Planning

One of the most compelling aspects of IPP Life Insurance is its unparalleled ability to facilitate wealth transfer and robust estate planning. The guaranteed death benefit serves as a direct, tax-efficient channel for passing on assets to heirs, charities, or other designated beneficiaries. This makes IPP an invaluable tool for:

- Leaving a Lasting Legacy: Beyond financial assets, IPP allows you to define the impact you wish to have. Whether it’s funding a child’s education, supporting a beloved cause, or ensuring the continuation of a family business, the death benefit can solidify these intentions.

- Estate Equalization: For families with illiquid assets like a business or property, IPP can provide cash to non-inheriting beneficiaries, ensuring a fair distribution of wealth without forcing the sale of assets.

- Minimizing Estate Taxes: When structured correctly, IPP policies can provide the liquidity needed to cover potential estate taxes, preventing the forced liquidation of other assets to pay these duties.

- Charitable Giving: IPP can be used to make a substantial future gift to a charity at a relatively low current cost, allowing policyholders to leave a significant mark on causes they care about.

The Numbers Game: Decoding Policy Mechanics

Making smart, informed policy choices requires more than just understanding the benefits; it demands an appreciation for the ‘math’ behind IPP. The principles of premium payments, present value, and risk assessment (as discussed in our previous section) are not just actuarial concepts; they are the bedrock of strategic policy selection.

- Understanding Premium Payments: Premiums are calculated based on your age, health, policy type, and the desired death benefit. A higher death benefit or a more complex policy (e.g., one with a cash value component) will typically involve higher premiums. Understanding these factors allows you to budget effectively and choose a policy that is sustainable for your financial situation.

- Grasping Present Value: The concept of present value is crucial when evaluating the long-term cost and benefit of an IPP policy. It helps you understand the current worth of a future death benefit, allowing for a more accurate assessment of the policy’s value proposition over time. A dollar today is worth more than a dollar tomorrow, and applying this to your premiums versus future payout helps in decision-making.

- Leveraging Risk Assessment: Your personal risk profile (health, lifestyle, family history) directly impacts the cost of your insurance. By proactively managing your health and accurately disclosing information, you can influence your premium rates. Furthermore, understanding the insurer’s risk assessment process allows you to select policies from companies that align with your financial goals and offer competitive rates for your specific profile.

Tailoring Your Policy: Practical Advice for IPP Selection

Selecting the right IPP policy isn’t a one-size-fits-all decision; it’s a highly personal process driven by your unique financial security goals. Here’s actionable advice for policyholders in the United States:

- Define Your Goals Clearly: Before looking at policies, determine why you need IPP. Is it for income replacement, estate planning, charitable giving, or a combination?

- Assess Your Coverage Needs: Calculate how much coverage you truly need. Consider your debts (mortgage, loans), income replacement needs (for how many years?), future expenses (college, retirement for a spouse), and any specific legacy goals.

- Understand Policy Types:

- Term Life Insurance: Provides coverage for a specific period (term). It’s generally more affordable and suitable for covering temporary needs like a mortgage or until children are grown.

- Permanent Life Insurance (e.g., Whole Life, Universal Life): Provides lifelong coverage and often includes a cash value component that grows over time on a tax-deferred basis. It’s ideal for estate planning, long-term legacy goals, and wealth accumulation.

- Compare Quotes from Multiple Insurers: Rates can vary significantly between companies, even for similar coverage. Use independent brokers or online comparison tools to get a comprehensive view.

- Review the Insurer’s Financial Strength: Choose a company with a strong financial rating to ensure they will be able to pay claims in the future.

- Read the Fine Print: Understand all terms, conditions, exclusions, and fees associated with the policy. Pay attention to riders that might enhance or restrict coverage.

- Consult a Financial Advisor: A qualified advisor can help you navigate the complexities, align IPP with your overall financial plan, and select the most suitable policy for your circumstances.

To illustrate how different life stages and goals influence these choices, consider the following table:

Tailoring IPP Life Insurance to Your Life Stage and Financial Goals

| Life Stage / Financial Goal | Typical IPP Considerations | Death Benefit Focus |

|---|---|---|

| Young Professionals/New Families | Debt protection (mortgage, student loans), income replacement for dependents, future planning. | High enough to cover all major debts, replace several years of income for a spouse/children, and fund initial college savings or childcare. Often favors affordable Term Life for max coverage. |

| Mid-Career/Growing Families | Long-term income replacement, college funding, business succession planning, wealth growth. | Substantial to cover increased lifestyle costs, future education expenses, provide liquidity for a business, and begin building a tax-advantaged legacy. Blends Term and Permanent Life. |

| Pre-Retirement/Empty Nesters | Estate equalization, charitable giving, supplementary retirement income (cash value), final expenses. | Designed to equalize inheritances, fund philanthropic endeavors, potentially provide tax-free income, and ensure final expenses are covered without burdening the estate. Leans towards Permanent Life. |

| Retirees/Elderly | Wealth transfer to heirs, minimizing estate taxes, legacy preservation, covering final expenses. | Primarily for guaranteed wealth transfer, providing liquidity for estate taxes, and ensuring dignity in end-of-life expenses. Typically Permanent Life, often with smaller face amounts. |

IPP: More Than Just Coverage, It’s Empowerment

Ultimately, Individual Premium Payment (IPP) Life Insurance is far more than a contractual agreement for a death benefit. It’s a strategic financial planning asset that puts you, the policyholder, in control of your financial destiny and legacy. By understanding its mechanics, integrating it into your broader financial strategy, and making informed choices, you empower yourself to build lasting security, transfer wealth efficiently, and leave the legacy you envision. It’s an active step towards comprehensive financial well-being, ensuring peace of mind for both today and tomorrow.

With these strategies in mind, you’re well-equipped to explore your own path to financial security with IPP Life Insurance.

Having explored the fifth crucial secret of strategic financial planning with IPP Life Insurance, it’s time to consolidate your understanding and pave your personal path to security.

From Secrets to Security: Charting Your Course with IPP Life Insurance

The journey to financial security is often paved with informed decisions, and understanding the robust framework of Individual Premium Payment (IPP) Life Insurance is a cornerstone of this process. We’ve delved into several fundamental concepts, uncovering the ‘secrets’ that transform a simple insurance policy into a powerful financial instrument. Now, let’s bring these insights together, illuminating the clear path forward.

Unlocking the Five Pillars of IPP Financial Wisdom

Throughout our discussions, five key secrets about IPP Life Insurance and its underlying mathematics have been revealed, offering a comprehensive view from premium payments to sophisticated risk assessment. These aren’t just abstract ideas; they are practical insights designed to empower your financial planning:

- Secret #1: The Power of Actuarial Precision in Risk Assessment. We’ve learned how actuaries use demographic data, health indicators, and sophisticated statistical models to meticulously calculate risk. This precision directly influences your premium payments, ensuring they are fair and sustainable, and ultimately guarantees the insurer’s ability to pay out death benefits. Understanding this allows you to appreciate the scientific basis of your coverage.

- Secret #2: Decoding the Time Value of Money (TVM). This principle highlights that a dollar today is worth more than a dollar tomorrow. For IPP, TVM explains how early premium payments, even seemingly small ones, have a greater impact on your policy’s long-term value and the ultimate death benefit. It underpins the benefit of starting your coverage sooner rather than later.

- Secret #3: The Significance of Present Value (PV) in Future Benefits. Related to TVM, Present Value helps you understand the current worth of a future payout, such as your death benefit. By discounting future cash flows, you can assess the true financial commitment and return of your IPP policy in today’s terms, making the vast future sums more tangible and comprehensible.

- Secret #4: Strategic Premium Structuring. Beyond just paying premiums, we explored how the structure and consistency of your individual premium payments contribute to the policy’s cash value growth and stability. Whether fixed or flexible, understanding the impact of your payment schedule on policy performance is crucial for maximizing its potential.

- Secret #5: The Leverage of Lifelong Coverage and Tax Advantages. Many IPP life insurance policies offer lifelong coverage and can accumulate cash value on a tax-deferred basis. This provides not only a guaranteed death benefit for your beneficiaries but also a potential source of accessible funds during your lifetime, leveraging favorable tax treatment under current United States laws.

The Mathematical Blueprint: Your Guide to Informed Decisions

The true value of these insights lies in their application. Understanding concepts like Present Value, the Time Value of Money, and the principles of Actuarial Science isn’t merely academic; it’s essential for making truly informed decisions about your IPP life insurance coverage. These mathematical tools demystify how premiums are set, how your policy’s cash value grows, and how the ultimate death benefit is calculated and guaranteed. They allow you to look beyond the surface and grasp the intricate workings that secure your financial future. When you understand the ‘why’ behind the numbers, you gain confidence and control over your financial planning.

Empowering Your Future with IPP Life Insurance

IPP Life Insurance in the United States offers a powerful avenue for taking control of your financial destiny. By grasping the strategic implications of your premium payments and the mathematical principles that govern your policy, you move from being a passive policyholder to an active participant in your financial well-being. This knowledge empowers you to select coverage that genuinely aligns with your personal circumstances, risk tolerance, and long-term financial objectives, ensuring your policy is a truly effective tool for wealth preservation and transfer.

Your Next Step: Crafting Your Personalized IPP Strategy

Now that you’re equipped with a deeper understanding of IPP Life Insurance and the sophisticated mathematics that underpin its value, the final step is to translate this knowledge into a personalized action plan. The nuances of your individual financial situation, family needs, and future aspirations demand a tailored approach. Don’t navigate this complex landscape alone. We strongly encourage you to consult a qualified financial advisor who can help you synthesize these insights, craft an IPP strategy specific to your unique needs, and ultimately secure your future and the invaluable death benefit for your loved ones.

With this comprehensive understanding, you are now equipped to explore the tangible applications and benefits of integrating IPP into your broader financial portfolio.

Frequently Asked Questions About IPP Math Insurance: Unlock Financial Security with This Secret

What exactly is IPP Math Insurance?

IPP Math Insurance isn’t a standard insurance product. It refers to strategies using mathematical principles to optimize insurance coverage and financial planning. The goal is to maximize benefits while minimizing costs, achieving financial security through informed decisions about your ipp math insurance.

How can math be applied to insurance?

Mathematical modeling helps assess risk and predict future financial needs related to insurance. This involves calculating probabilities, understanding investment returns, and optimizing policy selections. By understanding the math behind insurance products, you can make smarter ipp math insurance choices.

What kind of financial security does IPP Math Insurance provide?

It helps ensure you’re adequately covered for potential risks without overpaying for insurance premiums. It provides a framework for evaluating different policies, determining optimal coverage amounts, and planning for long-term financial needs using ipp math insurance strategies.

Where can I learn more about IPP Math Insurance?

Research resources on financial modeling, insurance analysis, and risk management. Consult with financial advisors specializing in mathematical approaches to financial planning. Understanding these principles will allow you to make well-informed ipp math insurance decisions.

You’ve now uncovered the 5 essential ‘secrets’ of IPP Life Insurance, revealing the powerful mathematics that underpins everything from your initial premium payments to the intricate process of risk assessment. We’ve demystified how concepts like Present Value, the Time Value of Money, and Actuarial Science are not just academic theories, but practical tools that ensure your policy’s stability and value. By understanding these principles, you’re no longer a passive observer but an empowered participant in your financial planning.

Don’t let your journey to financial security remain a mystery. Take control, leverage the robust power of Individual Premium Payment (IPP) Life Insurance in the United States, and secure that vital death benefit for your loved ones. The next crucial step? Consult a qualified financial advisor today to tailor an IPP strategy that perfectly aligns with your unique goals and aspirations, transforming knowledge into lasting peace of mind.